Meet Dyanne Prinsen With over 25 years in the industry, Dyanne comes with an abundance…

Keep calm – Don’t turn your paper loss into a real loss

The last few weeks have not been fun to watch for anyone invested in the Australian stock market. The spread of COVID-19 and the societal response has caused a negative growth shock similar to that of the GFC. The degree to which the Australian stock market will be affected is challenging to assess as the spread, success of containment, consumer and business behaviours, monetary and fiscal policy responses are still evolving, and opinions are at best an educated guess. During these times of market turbulence, it is important to remain calm and remember your longer-term investment goals. Markets will always go up and down. Many market declines that were scary in real time look like small blips over the long term (see the charts below).

Selling will realise the loss

It is important to control your response to the current situation. Selling shares or switching to a more conservative investment strategy after a major fall turns a paper loss into a real loss and therefore provides no hope of recovery. It is “incredibly dangerous” to sell stock after a huge market fall, according to AMP Chief economist Shane Oliver. Instead it is prudent to remain calm and look at your investment in terms of your broader investment strategy and timeline. Chief Investment Officer of AustralianSuper, Mark Delaney, says even if you are close to retirement, you still need to have a long-term investment strategy as you might have 20- or 30-year investment horizon. It is therefore important not to panic. Time is on your side.

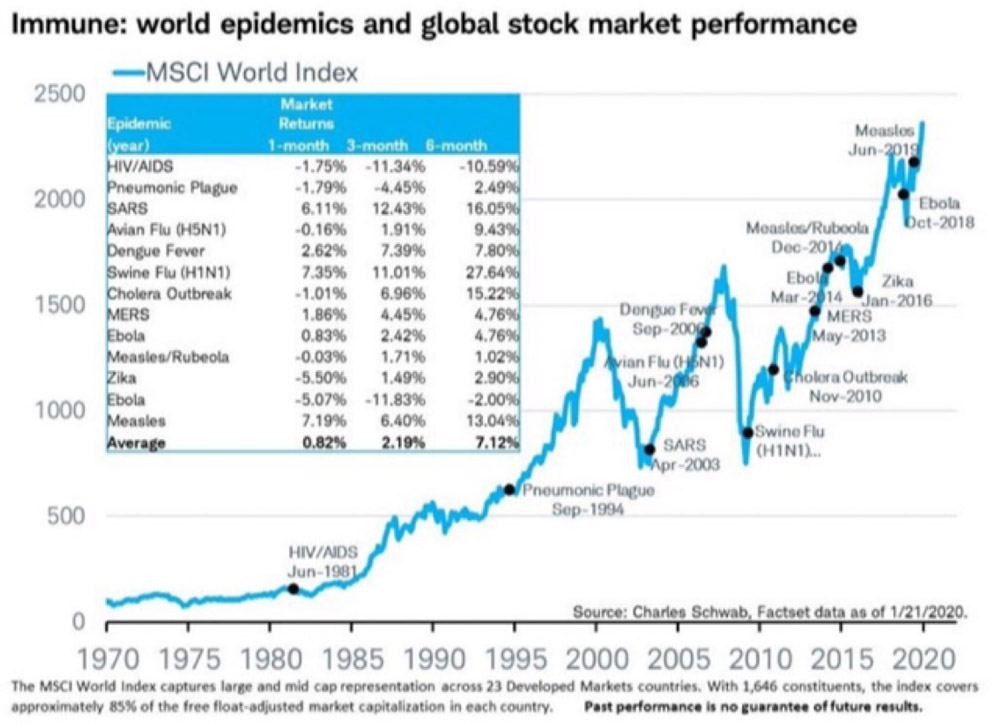

Over the last 50 years (1970 – 2020) there have been 13 world epidemics. The chart below (Chart 1) shows the impact each one had on markets. The graph shows the world has gotten through each challenge and the market continued and hit new highs.

Chart 1

The below chart shows you 120 years of investment returns on the Australian stock market. As you can see there are a number of times when markets have fallen but by staying committed to their investment strategy and not panicking has rewarded investors with long term returns. If you look back at the last 30 years of the Australian Stock market on the above chart, there has been healthy growth. A $10,000 investment into Aussie shares in 1990 would be worth $136,000 today, providing an annual return of 9.10%. It is therefore important in times like this to remain calm. Stay committed to your investment strategy and ride out the uncertain times if possible.

Chart 2

Understand how markets work

Investing in the share market provides higher returns because it has a higher risk profile than cash or bonds. This means a diverse portfolio of Australian and International shares returns more than cash or bonds over the long term, but the trade-off is that it can lose money in the short term. Fluctuations in share prices (also known as volatility) are often triggered by world events (e.g. Coronavirus, GFC, 9/11) and fear (consumer behaviour e.g. Australia’s toilet paper crisis) this is a normal part of the process.

The most important point is that a “loss” is only realised if you sell out. If you stay invested over time, as in the past, markets recover.

According to Matt Reynolds from Capital Group you wouldn’t be human if you didn’t fear loss, noting that Nobel Prize-winning psychologist Daniel Kahneman demonstrated this with his loss-aversion theory, showing that people feel the pain of losing money more than they enjoy gains. As such, investors’ natural instinct is to flee the market when it starts to go south, just as greed prompts us to buy back in when stocks jump. Both reactions can have negative impacts. Smart investing requires focusing on your strategy, strong research and data, and keeping calm. Below are six principles that can help fight the urge to make emotional decisions in times of market turmoil from Matt Reynolds article “6 Ways to Fight Fear with Facts”:

- Market declines are part of investing

- Time in the market matters, not timing the market

- Emotional investing can be hazardous

- Make a plan and stick to it

- Diversification matters

- The market tends to reward long-term investors

Read the full article here.

The opportunity

“Be fearful when others are greedy. Be greedy when others are fearful” – Warren Buffet.

Market pullbacks provide opportunities for investors to buy shares more cheaply. When the markets do recover, and history tells us they will, there will be great purchasing opportunities to be had by taking advantage of the cheaper share prices.

Those of you that have regular contributions going into your superannuation (e.g. employer SGC and/or personal contributions) and investment accounts (regular savings) have an excellent opportunity to benefit significantly over the long term as a result of this volatility in markets today. This is because of dollar cost averaging.

Dollar-cost averaging

Dollar-cost averaging is a strategy whereby you invest a fixed amount of money in an asset once every fixed time period (for example $500 per month). With dollar-cost averaging, you don’t have to focus on whether the price of your chosen investment is up or down. You simply invest the same amount every month at the same time of the month, then let market movements smooth out your purchase price over time. This type of strategy takes the emotion out of investing. If dollar-cost averaging is part of your investment strategy it is important to stay committed and to not lose track of your long-term goals.

The theory behind dollar cost averaging allows for peak and troughs in the market. To average out the price of your investments) it is important to continue to buy during the troughs. These troughs are usually the times when there is fear and uncertainty in the market and it feels like you should hold onto your money, however, it is also the time when asset’s price drops and you will be getting more shares of the asset for the same amount of money. As the price recovers, you will have spent less per share, on average, than if you had bought the shares at their peak pre-fall price.

Remember, it is natural for markets to go up and down. Many market declines that were scary in real time look like small blips on the long-term chart. Focus on your long-term investment goal and timeline.

A note for pensioners and retirees

The impact of the fall in the market should not be as great for those who are pensioners or retirees as their portfolios generally have a more conservative approach and are not as exposed to the share market.

Rising bonds (as yields fall) are helping to offset falling equity prices in balanced (defensive) portfolios. We would expect the markets’ long-term dynamics of rising equity prices and falling bond prices (as yields increase) to hold during an eventual equity market rebound.

The information within, including tax, does not consider your personal circumstances and is general advice only. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser.

The views expressed in this publication are solely those of the author; they are not reflective or indicative of licensee’s position and are not to be attributed to the licensee. They cannot be reproduced in any form without the express written consent of the author.

Singleton Financial Planning Pty Ltd and its advisers are Authorised Representatives of RI Advice Group Pty Ltd, ABN 23 001 774 125 AFSL 238429.

1.

Keep calm – Don’t turn your paper loss into a real loss